The Financial Advantage of Homeownership

New Title

The Long-Term Financial Advantage of Homeownership

If you’ve been comparing renting vs. buying lately, you’re not alone. Renting can feel cheaper, simpler, and more predictable—no repairs, no property taxes, no maintenance surprises. You write the check and move on with your day.

But here’s what often gets overlooked: renting doesn’t help you build your financial future. Homeownership does.

For most people, a home isn’t just a place to live. It’s the primary way they grow wealth over time—without changing anything about their day-to-day lifestyle.

Renting vs. Owning: The Real Cost Difference

At its core, the difference between renting and owning comes down to where your monthly payment goes.

When you rent:

Your payment goes to your landlord. Once it’s paid, that money is gone.

When you own:

A portion of your payment comes back to you in the form of equity—the wealth you build as your home increases in value and as you pay down your mortgage.

So even if renting feels more affordable today, it comes with a long-term cost: you’re not building net worth.

And the gap between these two paths is bigger than most people realize.

What the Long-Term Data Shows

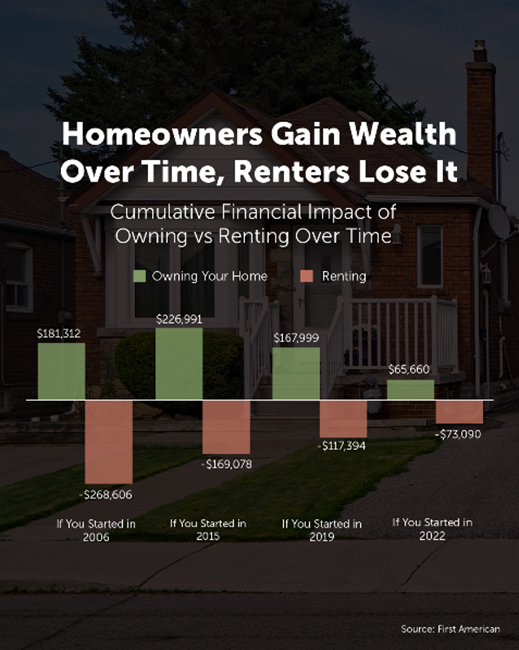

First American recently did a deep financial analysis comparing renters and owners over multiple major time periods:

- 2006 (start of the housing bubble)

- 2015 (10 years ago)

- 2019 (pre-pandemic “normal” market)

- 2022 (when mortgage rates jumped)

They factored in everything: mortgage payments, taxes, insurance, maintenance, appreciation, and equity gained from paying down the loan.

Across every time period, two things were consistent:

- Renters ended up losing money over time.

- Homeowners built wealth—often substantially.

In other words:

Time in a home builds wealth. Time renting doesn’t.

Even after accounting for repairs, insurance, and property taxes, homeowners came out ahead in every scenario. Meanwhile, renters continued to spend money without gaining a long-term financial benefit.

Buying doesn’t always win in the short term—everyone’s situation is different—but the longer you own, the wider the wealth gap becomes.

Affordability Is Starting To Improve

You might still be thinking, “That’s great, but buying feels out of reach right now.”

That’s fair. The past few years have been challenging for buyers. But there’s good news: the market is shifting.

- Mortgage rates have started to ease.

- Home price growth is slowing.

- Incomes have been rising.

- Zillow reports that typical monthly payments are slightly more manageable compared to this time last year.

Buying isn’t suddenly easy—but it is becoming more attainable than it was a few months ago. And historically, the long-term payoff has always favored ownership.

Bottom Line

Renting may feel simpler and less expensive today, but owning is what builds real wealth over time. With affordability beginning to improve, the path to homeownership might be more open than you think.

If you’re curious what buying could realistically look like for you, let’s connect. No pressure—just a conversation about your options and how to make the numbers work.